Gross Pay Unemployment Benefits

In order to calculate gross wages for unemployment benefits you will first need to gather your pay stubs and take note of all deductions that have occurred. In order to request non-charging base period employers must complete and return the Notice of Initial Claim and Potential.

Child Support Is Influenced By Each Parents Income Pin As A Reference For What Child Support Humor Child Support Quotes Child Support Child Support Payments

This definition will be used going forward and will also be applied retroactively.

Gross pay unemployment benefits. Unemployment does not pay 100 percent of the wages the individual once earned. State laws typically put a maximum percentage in place often between 70 and 80 percent of the salary the individual earned per week but plans factor other data before creating a payment plan including how much individuals earned and how long they had been at that payment level. Experience-rated employers can request that benefits not be charged to their accounts in certain situations.

If you collect income while on unemployment benefits Vermont will disregard 12 of gross wages. Any amount over one-half of your weekly benefit amount will be subtracted from. De très nombreux exemples de phrases traduites contenant pay unemployment benefit Dictionnaire français-anglais et moteur de recherche de traductions françaises.

Unemployment benefits are used to help workers who lost their jobs by no fault of their own. This allowed us to set a new definition of gross earnings that will mean some self-employed PUA claimants can get higher weekly benefit payments. To file for unemployment you must be ready and willing to.

If your remuneration is less than the unemployment benefits otherwise due you your unemployment benefits will be reduced by the amount of your annuity pension etc. You can calculate your gross pay by multiplying your hourly wage by the number of hours you worked. Gathering the Necessary Information.

You might be eligible to claim unemployment benefits if your weekly severance pay is less than the maximum weekly unemployment insurance rate. You should plan on covering a full year of pay stubs. If you lose your job and its not your fault chances are you are eligible to receive unemployment benefits through the Department of Labors USDOL Unemployment Insurance UI programs.

The maximum coverage for unemployment benefits is 26 weeks. Net pay is the amount you take home after deductions. It is possible to receive a partial unemployment benefit payment for a week even when your gross income is greater than your weekly benefit rate WBR.

First check your states unemployment website to find out how your gross pay is. Gross pay is what youve earned before taxes. Retirement pay from a base period employer or from a fund towards which a base period employer has contributed.

To calculate gross wages earned each day you must multiply the total hours worked by the rate of pay. As of October 4 2020 the maximum weekly benefit amount is 855 per week. This calculator helps you estimate your benefits.

For each week in which and for 52 weeks thereafter if the. You typically can file weekly online by. Benefits are not based on financial need.

The amount that you would be required to report on your weekly claim is the grand total of all the daily earnings along with the grand total of the number of hours worked. Your benefits might come in the form of a check but more often they will come in the form of a debit card or direct deposit to your bank account. Requests for non-charging are submitted by timely responding to notices issued by DES.

On August 5 2020 the US. When you file for payment you must report your gross pay. In Texas severance may delay or stop receipt of unemployment benefits and payments will be delayed until the payments.

If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200. Before you can get started youll need some basic information. For Example A you would report working a total of 9 hours and gross wages of 7200 regardless.

Actual pay percentages may only be. If you are eligible to receive Unemployment Insurance UI benefits you will receive a weekly benefit amount of approximately 50 of your average weekly wage up to the maximum set by law. Once you file for unemployment and are approved you will begin to receive benefits.

It varies by state. New Exclusion of up to 10200 of Unemployment Compensation. Gross earnings not more than 15 times your weekly unemployment rate If you earn more than 100 up to but not equal to your weekly benefit rate in any week subtract half of your earnings from the payment If you earn an amount equal to your weekly benefit rate but not more than 15 times your payment during a week Multiply your weekly benefit rate by 15 and subtract the total amount you.

Department of Labor issued new guidance on how states can define gross earnings for weekly Pandemic Unemployment Assistance PUA claims. However you will not receive benefits if you work a total of 32 or more hours for all employers in a week you are claiming or if your total gross pay is more than 50000. As an employer how can I request non-charging of unemployment benefits.

An example of how to calculate your payment is on page 5.

Pin On دورات ربانية لريادة الأعمال

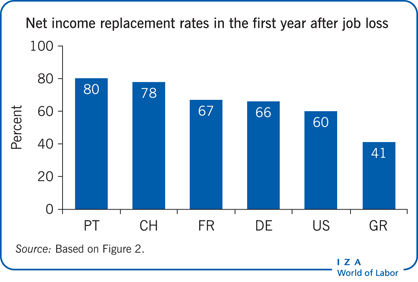

Infographic The Countries With The Best Jobless Benefits Social Data Infographic Country

Iza World Of Labor Unemployment Benefits And Unemployment

Pin On Document Template Example

Social Protection Statistics Unemployment Benefits Statistics Explained

Social Protection Statistics Unemployment Benefits Statistics Explained

Social Protection Statistics Unemployment Benefits Statistics Explained

Today S Headline From Three Perspectives International Development Personal Finance Finance

Social Protection Statistics Unemployment Benefits Statistics Explained

Social Protection Statistics Unemployment Benefits Statistics Explained

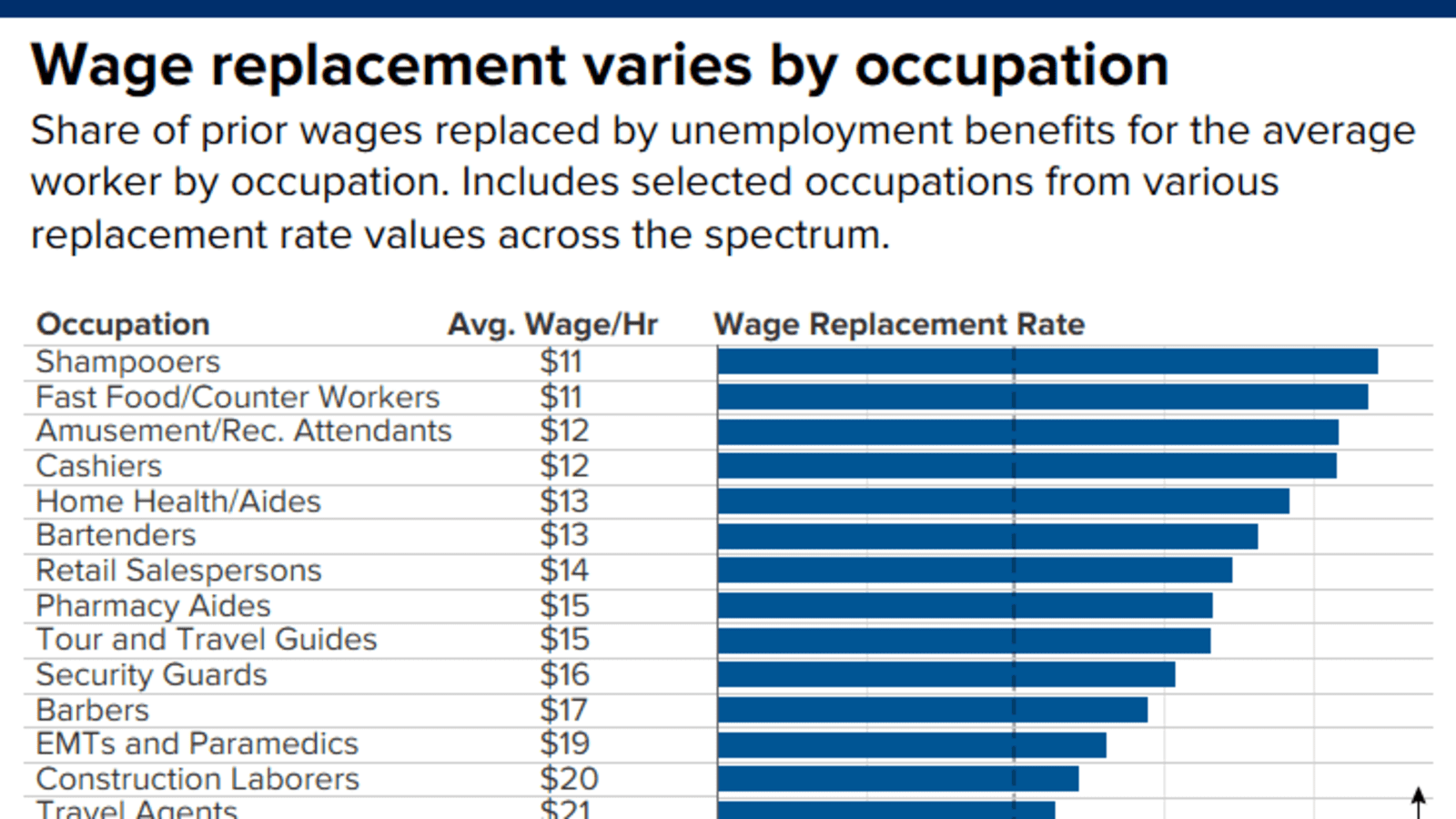

Unemployment Benefits Comparison By State Fileunemployment Org

Why Is Gross Income Not Net Income Used For Child Support Payments In 2020 Child Support Payments Net Income Child Support

It Pays To Stay Unemployed That Might Be A Good Thing

Social Protection Statistics Unemployment Benefits Statistics Explained

Post a Comment for "Gross Pay Unemployment Benefits"