What Percentage Of Gross Pay Goes To Taxes

This eats away at your income by another 765 for employees or 153 for those who. However for 2011 the employee side only has been lowered to 42 percent so you can expect to see 42 percent of your gross pay go to pay this tax.

What Do They Pay What Do You Pay Federal Income Tax Income Tax Tax

The current rate for Medicare is 145 for the employer and 145 for the employee or 29 total.

What percentage of gross pay goes to taxes. The 12 bracket went up to 80250. So 025 becomes 25. Divide deductions by gross income.

A profit margin is the amount of money your business makes after you have deducted your business expenses. And then youd pay 22 on the rest because some of your 50000 of taxable income falls into the 22 tax bracket. If you do not have nontaxable deductions all of your wages are subject to Medicare tax.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. And so it goes through the various levels until the brackets top out at 37 518401 for single filers. The 22 bracket went up to 171050 and so on.

For instance if you make anywhere between 0 - 9950 annually in 2021 for Tax Day in 2022 you owe 10 of that to the government in taxes. You may want to use a calculator here 150600 025 Convert 025 to a percent by moving the decimal point two places to the right and adding the percent sign. Your employer is responsible for matching this amount for a total of 124 that the government receives to fund the program.

If you earn over 200000 youll also pay a 09 Medicare surtax. The top rate 37 applied when taxable income topped 622050. The normal rate for both the employer and the employee side of the Social Security tax is 62 percent for a total tax of 124 percent.

If youre married your total withholding also decreases. Combined the FICA tax rate is 153 of the employees wages. Medicare taxes follow a similar process with 145 being collected from both you and your employer for a total of 29.

Net pay is the amount of money left over after all taxes deductions and optional contributions have been made. According to the Tax Policy Center 44 of households pay no Federal income tax at all. Your employer matches the 62 Social Security tax and the 145 Medicare tax in order to.

Social Security tax is a federal payroll tax that employers and employees pay. The 10 bracket applied to the first 19750 in taxable income. Of those only about 150 million have to file taxes at all based on their income.

You will withhold 8562 plus 22 percent of the money earned over 815. 975 of revenue goes to expenses and taxes leaving 25 profit. How Are Business Expenses Related to Profit Margins.

In the gross pay vs net pay discussion net pay is the amount of take-home money that an employee expects to receive when their job duties are fulfilled. Whether your taxable income is 40000 a year 400000 or 40 million the first 10000 you earn is taxed the same 10. This means you pay taxes on pieces of your income not the entire thing.

For example if your pay is more than 209 but not more than 721 your employer will multiply your pay by 15 percent and add 1680 to the result to determine your tax withholding. Your taxable wages is your pay after your employer subtracts nontaxable deductions such as a Section 125 medical or dental plan. There is a wage base limit on this tax.

Your employer withholds a 62 Social Security tax and a 145 Medicare tax from your earnings after each pay period. Current FICA tax rates. Your business expenses and profit margins have a direct relationship.

Then you have the other 56. If you earn anywhere between 9951 and 40525 you will owe 995 plus 12 of the amount you make over 9950 the top of the previous bracket. The total that you withhold each week from your paycheck for your federal taxes is 106.

Currently you pay 145 percent of all your taxable wages for Medicare tax. Any income you have in excess of 200000 is subject to an additional Medicare surtax of. This is divided up so that both employer and employee pay 62 each.

The total bill would be about 6800 about 14 of. As for your FICA taxes 62 of your income goes to Social Security taxes. That means that not a single person in those households pays Federal income tax.

The same goes for the next 30000 12. Next comes the Social Security and Medicare taxes which are also a payroll deduction if employed. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

If you have more withholding allowances your withholding total decreases. It takes anywhere from 10 396 of your total income depending on your filing status number of dependents and total household income. The average person pays 17 of their gross income to this federal tax.

For the 2019 tax year the maximum income amount that can be subjected to this tax is 132900.

Tax Flow Employee Discounts By Margaret Hagan C 2012 All Rights Reserved Related Flow Chart Employee Discount Tax

Irs Filing Delays Errors Can Cause Problems For Fafsa S Irs Data Retrieval Tool Financial Aid Financial Aid For College Fafsa

The Tax Burden Across Varying Income Percentiles Income Adjusted Gross Income Tax

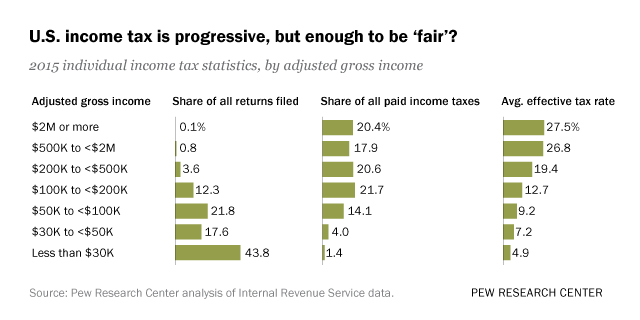

This Bar Graph Breaks Down Total Federal Income Tax Revenues By The Earnings Percentiles Of The Americans Who Paid Them Federal Income Tax Income Tax

Who Pays U S Income Tax And How Much Pew Research Center

Infographic Of The Day Income Needed To Be A Top Earner Income Inequality Inequality Income

Was Mitt Romney A Member Of The 47 Percent Paying Taxes Payroll Taxes Tax

I Thought It Would Be Fun To Share What Percent Of My Paycheck I Get To

A Closer Look At Those Who Pay No Income Or Payroll Taxes Tax Policy Center Payroll Taxes Payroll Income

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Types Of Taxes Anchor Chart Financial Literacy Lessons Financial Literacy Anchor Chart Teaching Economics

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Your Chances Of Getting Audited By The Irs This Year Irs Audit Income Tax

Who Pays U S Income Tax And How Much Pew Research Center

Quick Easy W 4 Calculator Accounting Services Tax Small Business Accounting

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Post a Comment for "What Percentage Of Gross Pay Goes To Taxes"