Annual Payroll Tax Calculator Qld

Less deduction is the annual deduction amount you are entitled to. - A three-month payroll tax holiday saving an average of 13360 In addition they will be eligible to defer all payroll tax payments for the rest of 2020.

How To Calculate Payroll Tax Deduction Victoria

Taxable amount is the taxable amount for the year after the deduction.

Annual payroll tax calculator qld. Enter the relevant data and click Calculate to determine your fixed periodic deduction. Calculating payroll tax You can work out how much payroll tax you need to pay that is your payroll tax liability by using this formula. Select the return type Choose the return type from the drop-down list.

A deduction may be available if your total annual Australian taxable wages are less than 65 million. Calculate your liability for periodic annual and final returns and any unpaid tax interest UTI. Periodic liability The periodic liability amount displays after you click Calculate.

Total Queensland taxable wages - Deduction Payroll tax rate Payroll tax liability. Annualfinal liability payroll tax calculator help. 475 for employers or groups of employers who pay 65 million or less in Australian taxable wages.

You must lodge your annual return by 21 July each year for the previous financial year and pay any outstanding amounts. Selected To activate press spacebar Navigation list Input field for file upload Read-Only Pager Item To select press spacebar To deselect press CTRL and spacebar To deselect all rows press CTRL and spacebar To select all rows press spacebar Column for row selection Breadcrumb navigation list Set the value using the arrow keys Press F4 to open the list and use the arrow keys to select a value Search Calculator. This means no eligible small or medium Queensland business will have to make a payroll tax payment this calendar year.

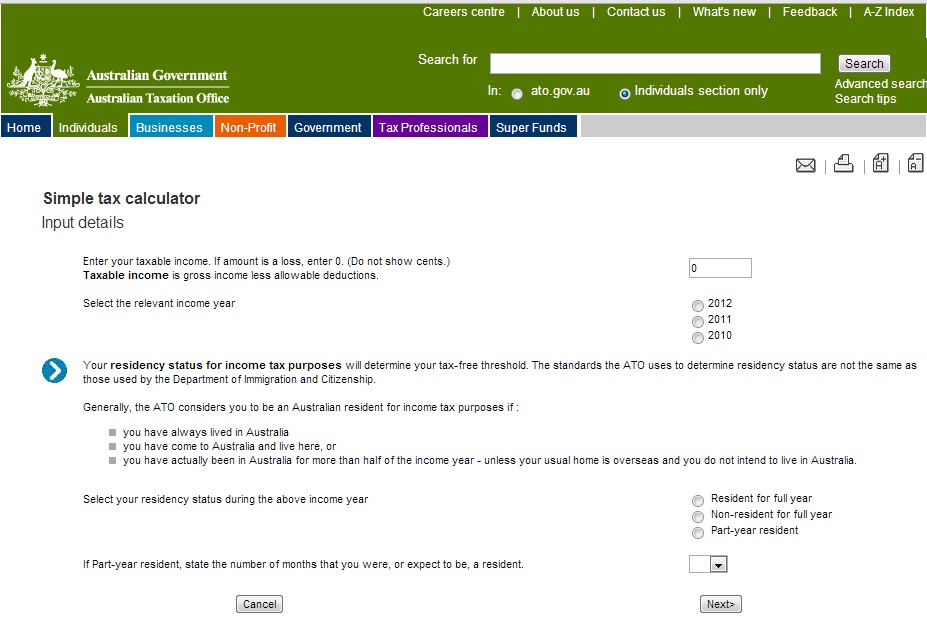

It can be used for the 201314 to 202021 income years. You can use our calculators to determine how much payroll tax you need to pay. The calculator helps you calculate your fixed periodic deduction for payroll tax.

Cash and non-cash wages. 2021 payroll annual payroll tax due date qld 2021 pay periods annual payroll tax due date qld 2021 pay schedule 3 annual payroll tax due date qld gsa opm federal pay scale. 11 Glossary of payroll tax terms Business Queensland.

If your apprentice and trainee wages are exempt from payroll tax you can also claim a payroll tax rebate that reduces your payroll tax amount for the particular liability periodic annual or final return. What payroll tax relief can large businesses get. Larger businesses payroll over 65 million.

Fixed periodic deduction payroll tax calculator help. Taxable wages for payroll tax. Terms used in the calculator.

Salary sacrifice amounts are cash wages that an employee has chosen to forgo in return for other benefits. The Queensland Government has announced changes to payroll tax rates and thresholds from 1 July 2019. Click Calculate to display unpaid tax interest details.

Fixed periodic deduction start date. Displaying search results 11 - 20 of 154 for payroll atx uwwwbusinessqldgovau. This link opens in a new window.

The calculator helps you to self-assess your annual or final payroll tax liability. Payroll Tax Rate in Queensland The payroll tax rate is. Terms used in the calculator.

This section shows the payroll tax calculation details and total amount payable. The Queensland Government has announced changes to payroll tax rates and thresholds from 1 July 2019. Queensland taxable wages is the total of the taxable wages entered in the QLD wages section.

Enter the relevant data and click Calculate to determine your liability. You must report the following taxable wages when lodging your payroll tax return in Queensland. This calculator is always up to date and conforms to official Australian Tax Office rates and formulas.

Calculated periodic liability for payroll tax. Read definitions for terms used when calculating payroll tax including taxable wages thresholds and a change of status. Unpaid tax interest UTI details.

Payroll tax rate This field displays the payroll tax rate applied to the calculation. The Queensland Government has announced changes to payroll tax rates and thresholds from 1 July 2019. 475 for employers or groups of employers who pay 65 million or less in Australian taxable wages 495 for employers or groups of employers who pay more than 65 million in Australian taxable wages.

It will take between 2 and 10 minutes to use this calculator. The annual payroll tax return breaks down the years taxable wages and is used to calculate your liability for the year. This is the amount of periodic liability calculated on your Queensland taxable wages in accordance with the Payroll Tax Act.

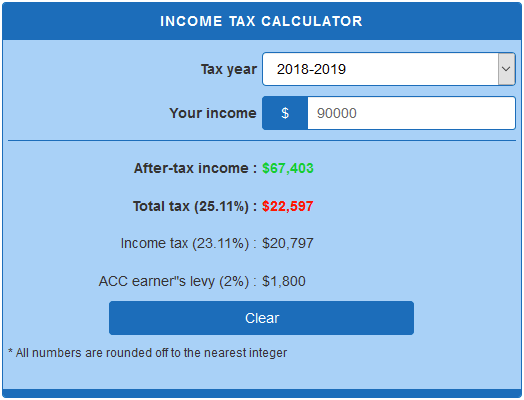

This calculator helps you to calculate the tax you owe on your taxable income. The payroll tax rate is. Use this calculator to quickly estimate how much tax you will need to pay on your income.

Apprentice and trainee rebate for payroll tax The Queensland Government has announced the payroll tax 50 rebate will continue after 1 July 2019. Enter the payroll tax for the period Enter the amount of payroll tax liability calculated on your Queensland taxable wages in accordance with the Payroll Tax Act 1971. 01 Jul 2021 QC 16608.

For annual Australian taxable wages over the 13 million threshold the deduction reduces by 1 for every 4 of taxable wages over this amount.

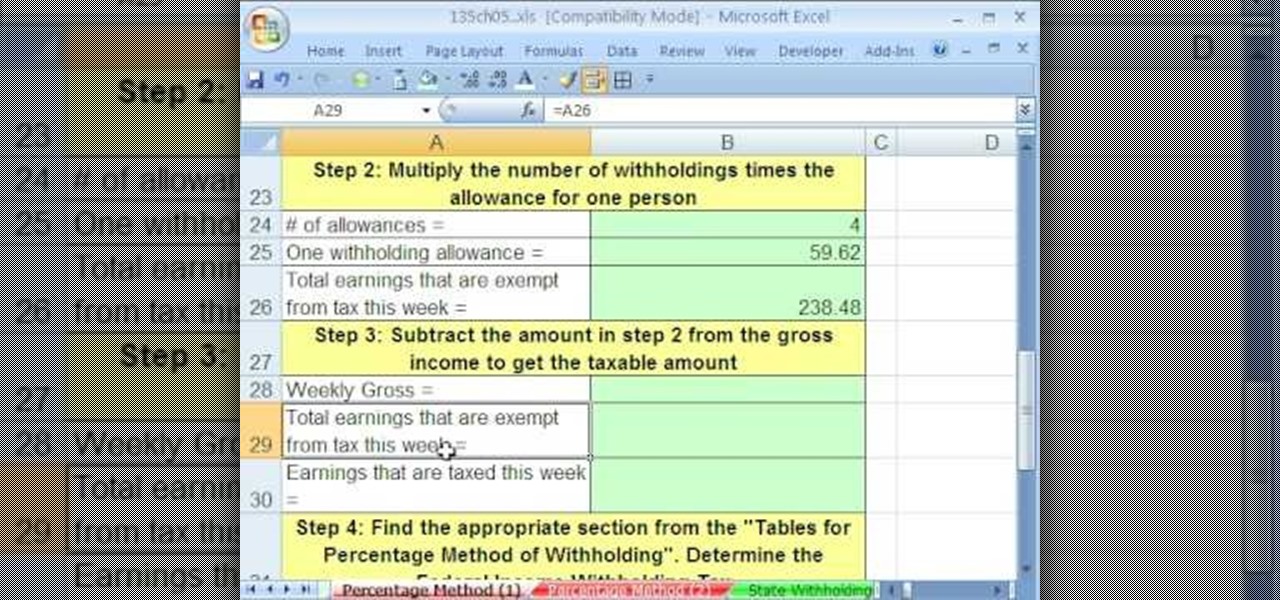

How To Calculate Tax Deductions For Payroll

Paycheck Calculator For Excel Paycheck Consumer Math Salary Calculator

How To Calculate Payroll Tax Deduction Victoria

Australian Tax Calculator Excel Spreadsheet 2018 To 2025 Atotaxrates Info

E Tax Depreciation Schedules Australia Can T Avoid Being Australia S Driving Firm Who Give The Best Cost Cheapening Organization Etax Tax Deductions Appraisal

Australian Tax Calculator Excel Spreadsheet 2018 To 2025 Atotaxrates Info

Payroll Tax Deductions Business Queensland

Online Australian Tax Return And Refund Calculator

How To Calculate Payroll Tax Deduction Victoria

Australian Tax Return Calculator Online Tax Australia

How Do I Calculate My Tax Refund Australia

Income Tax Calculator Jcm Finance Pty Ltd

Payroll Tax Deductions Business Queensland

How To Calculate Tax On Commission

Payroll Tax Deductions Business Queensland

Ato Tax Calculator 2021 2022 Tax Rates

Post a Comment for "Annual Payroll Tax Calculator Qld"