Hourly To Salary Ontario

You can factor in paid vacation time and holidays to figure out the total number of working days in a year. The Canada Hourly Tax Calculator is updated for the 202122 tax year.

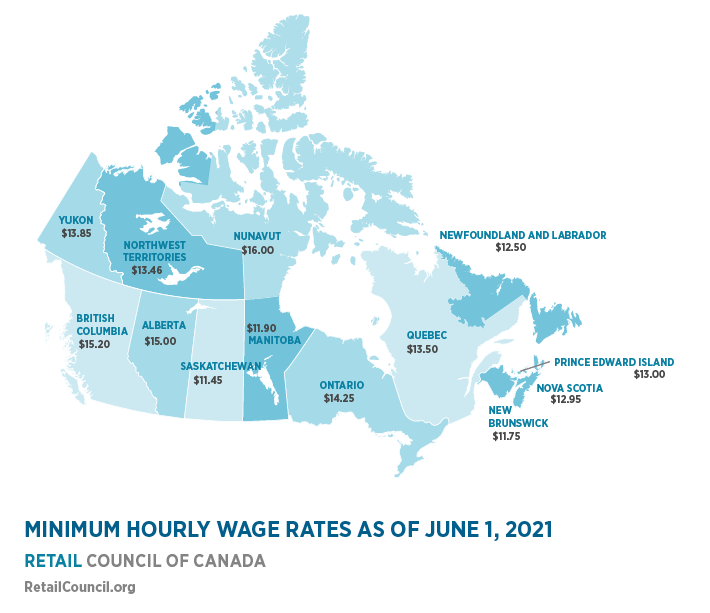

Minimum Wage By Province Retail Council Of Canada

Hourly Salary in Ontario CA.

Hourly to salary ontario. Enter your gross income. This is required information only if. 25152 - 29021 20 of jobs 29022 - 32891 19 of jobs 32892 - 36760.

Minimum wage increase in Ontario. Multiply Hours 17885 by the minimum wage in 2021 1425 hour 25 48613 in minimum salary per year. Make sure you are locally compliant with Papaya Global help.

3000 dollars hourly including un-paid time is 6240000 dollars yearly including un-paid time. EI deduction - 822. Net annual salary Weeks of work year Net weekly income.

Now you can go back to the Dues or Strike Calculator you were working on and enter the. Multiply that number by 52 the number of weeks in a year. Calculating an Hourly Wage from an Annual Salary.

Use the simple hourly Canada tax calculator or switch to the advanced Canada hourly tax calculator to review NIS payments and income tax deductions for 2021. Hourly Pay Rate. Global salary benchmark and benefit data.

If your hourly rate is 1750. Provincial tax deduction - 2783. Net pay 40568.

25 000 - Taxes - Surtax - CPP - EI 20 80248 year net 2094464 52 weeks 40278 week net 40278 40 hours 1007 hour net You simply need to the the same division for the gross. Salaries below this are outliers. Multiply the number of hours you work per week by your hourly wage.

Federal tax deduction - 5185. Where do you work. The amount can be hourly daily weekly monthly or even annual earnings.

How to Compare Hourly Salaries in Ontario Select Compare Salaries on the Ontario Salary Comparison Calculator Enter your current Hourly salary in Ontario or the first Hourly salary in Ontario you want to compare Enter the tax year you want. For example if you work for 25 hours and 30 minutes youll get paid for 255 hours. The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance.

Annual salary without commas average weekly hours average monthly commission without commas Take one of the two calculated amounts from the boxes on the right. Enter annual salary and average monthly commission. Enter the number of hours worked a week.

The salary calculator will also give you information on your daily weekly and monthly earnings. CPP deduction - 2643. Total tax - 11432.

Take for example a salaried worker who earns an annual gross salary of 25000 for 40 hours a week and has worked 52 weeks during the year. Enter your pay rate. According to statistics the minimum wage saw an increase in the general rate of about 158333 from january 1st 1965 to January 1st 2021.

A salary earner receives his salary regardless of hours worked. Unlike a salary compensation scheme an hourly wage earner will not be paid for any time they are not actually working. You can calculate your Hourly take home pay based of your Hourly gross income and the tax allowances tax credits and tax brackets as defined in the 2021 Tax Tables.

If you make 20 an hour and work 375 hours per week your annual salary is 20 x 375 x 52 or 39000. Annonce Payroll Employment Law for 140 Countries. If the employee has a very clear work week of 40 hours and a contract with no wiggle room for the employer to require more their hourly rate will be their salary divided by 40.

As an hourly employee you should get paid for all of the hours that you work. The calculator is updated with the tax rates of all Canadian provinces and territories. Remember that a full salary with benefits can include health insurance and retirement benefits that add more value to your total annual salary compared to similar hourly.

Salary Commission Payrate Employees Only. Annonce Payroll Employment Law for 140 Countries. But an hourly employee moving to a salaried job most frequently takes on the responsibility for the department they may formerly have just worked in.

If the employee is salaried as opposed to hourly the overtime rate is calculated by dividing their weekly salary by 44 to arrive at their hourly rate of pay. 17413 - 21282 6 of jobs 21283 - 25151 17 of jobs 25152 is the 25th percentile. If an employer wants more of your time theyll have to pay you more.

22 lignes To determine your annual salary take your hourly wage and multiply it by the number of. Global salary benchmark and benefit data. Gross annual income Taxes Surtax CPP EI Net annual salary.

Where an employee is paid by salary they will continue to be compensated despite any absences from work unless a policy regarding pro-rating the salary has been built into their. Moving From Hourly to Salary Additional Challenges In an employee participative empowering work environment the lines between salaried and hourly functions blur with respect to responsibilities. Make sure you are locally compliant with Papaya Global help.

Formula for calculating net salary. Income Tax Calculator Ontario Find out how much your salary is after tax.

Architecture Average Salaries In Ontario 2021 The Complete Guide

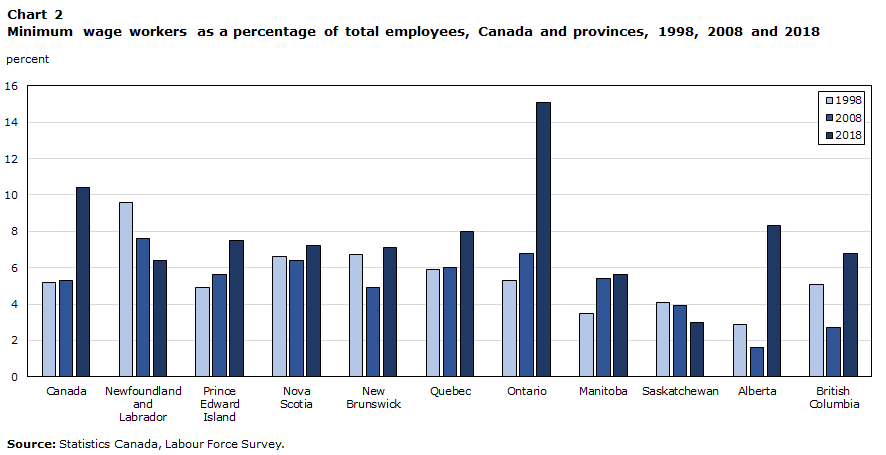

Did Ontario S Minimum Wage Hike Kill Jobs A Look At The Numbers 1 Year Later Huffpost Canada Business

Annual Salary To Hourly Rate Chart

Average Hourly Wages In Canada Have Barely Budged In 40 Years National Globalnews Ca

Oil Gas Energy Mining Average Salaries In Ontario 2021 The Complete Guide

Engineering Average Salaries In Ontario 2021 The Complete Guide

Escape Room Or A Breakoutedu Activity Designed To Cover The Following Topics Hourly Rate Overtime Piece Work Escape Room Ontario Curriculum Journey S End

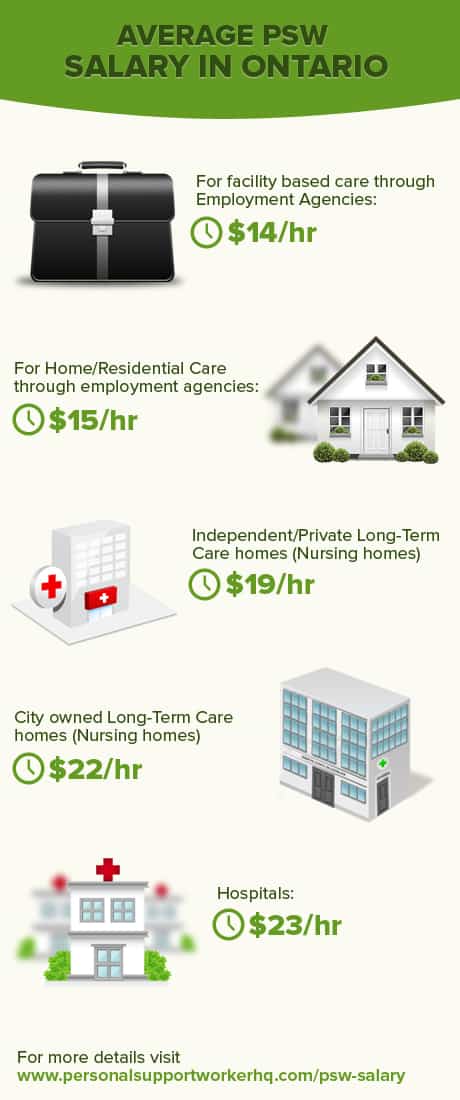

All You Need To Know About Psw Salary Increase

Packer Vegetables Farm Work In Canada Farming In Canada Farm Canada

The Surprising Impacts Of Ontarios Minimum Wage Increase The Toronto Observer

Average Salary In Ontario 2021 The Complete Guide

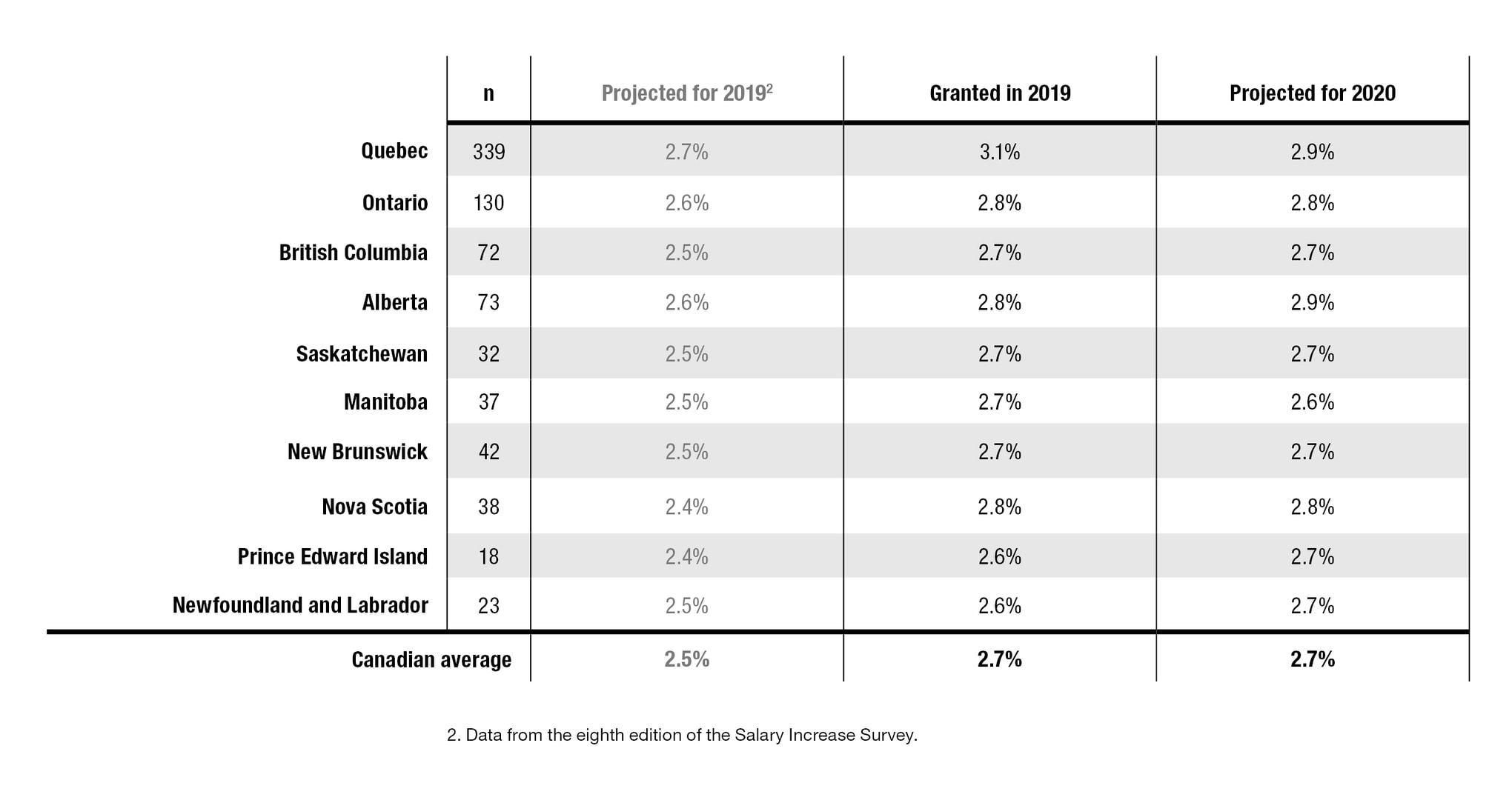

2020 Salary Increase Survey Results Normandin Beaudry

Information Technology Average Salaries In Ontario 2021 The Complete Guide

Ultimate Guide To Psw Salary In Ontario

Flight Attendants Salary Flight Attendant Become A Flight Attendant Good Paying Jobs

Farm Workers Vacancies In Ontario Multiple Positions No Experience Jobs Ontario Farm

Maid Salary In Canada 2019 Jobs In Canada Canada Salary Maid

Computer Systems Analyst Salary Good Paying Jobs Computer Science Degree Computer System

Post a Comment for "Hourly To Salary Ontario"