Gross Pay Definition

It is not limited to income received in cash. In economic terms a salary payment differs from a wage payment in two ways.

What Is Basic Salary Definition Formula Income Tax Exceldatapro

Net pay Your gross pay will often appear as the highest number you see on your pay statement.

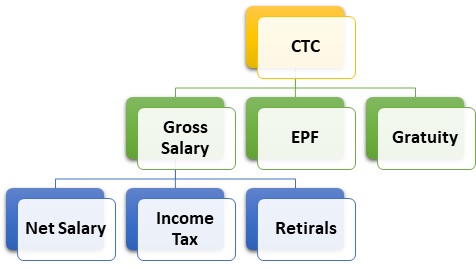

Gross pay definition. Gross salary refers to the full payment an employee receives before tax deductions and mandatory contributions are removed. Salaries Fixed compensation for services paid to a person on a regular basis. The earnings base is currently net-gross pay ie.

What is gross pay. A salary is similar to a WAGE payment in that it is paid for the use of LABOUR as a factor of production. Notice I didnt say it was the total amount paid to each employee.

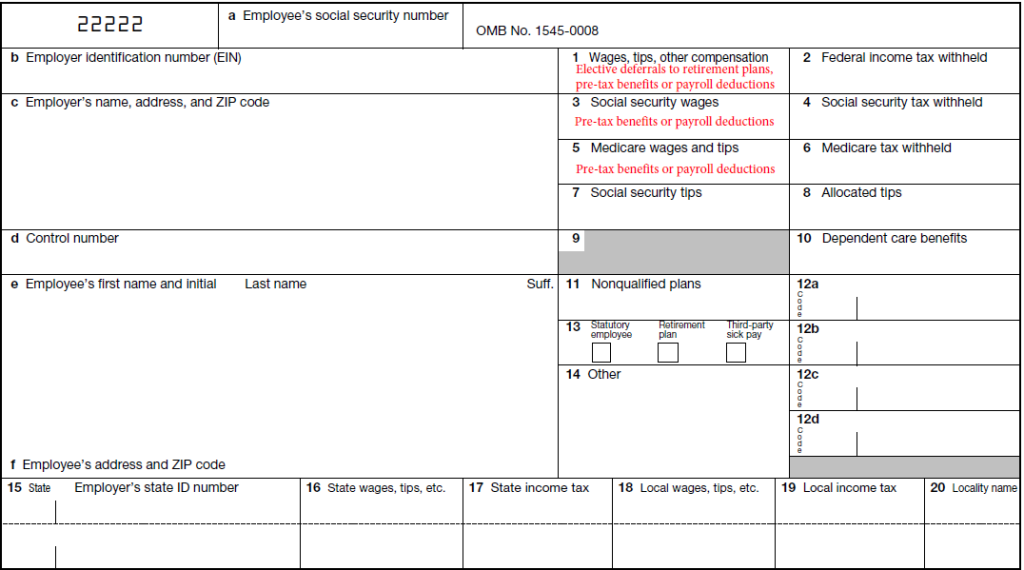

Gross pay is an individuals total earnings throughout a given period before any deductions are made. Gross pay is the amount an employee is paid before the employer withholds FICA Social Security and Medicare payroll taxes income taxes federal state local if applicable and other amounts such as wage garnishments insurance payments union dues. American Heritage Dictionary of the English.

An amount of pay wages salary or other compensation before deductions such as for taxes insurance and retirement. Your gross pay is the total amount your employer pays you. Gross pay is the total amount of money an employee receives before taxes and deductions are taken out.

Définitions de GROSS PAY synonymes antonymes dérivés de GROSS PAY dictionnaire analogique de GROSS PAY français. Taxable income is the. It also includes property or services received.

Gross pay typically consists wages salaries commissions bonuses and any other type of earnings before taxes. This is also the number that is seen in your contract. Deductions such as mandated taxes and Medicare contributions as well as deductions made for company health insurance or retirement funds are not accounted for when gross pay is calculated.

If you are a salaried employee your annual salary is your gross wage. Gross pay refers to the amount used to calculate the wages of an employee hourly or salary for the salaried employee. Gross pay or gross income is the amount of salary or wages paid to the individual by an employer before any taxes and deductions.

Payment Classe gross pay n. If you work on an hourly basis then your gross pay may vary from week to week. If you have a fixed salary then your gross pay is the value of that salary which youll find in your employment contract.

Gross pay is the individuals total pay from his or her employer before any taxes and deductions. Good-old-europe-networkeu Le salaire de référence qui est actuellement la rémunération brute-nette cest-à-dire la rémunération brute diminuée des cotisations salariales de toutes les années depuis 1988 se rapproche de la durée de la vie active. What is Gross Pay.

Gross pay is the amount your employer pays you based on your agreed-upon salary or an hourly wage. It is the total amount of remuneration Remuneration Remuneration is any type of compensation or payment that an individual or employee receives as payment for their services or the work that they do for an organization or company. Gross wage less employees contribution in all years since 1988 moving towards the full lifetime.

This amount is equal to your base salary plus all benefits and allowances such as special allowances overtime pay medical insurance travel allowance and housing allowance. Gross wages are the full amount an employee earns before taxes and other deductions are withheld from the paycheck. All calculations for employee pay for instance over time withholding and deductions are based on it.

The amount earned depends on the employment status and wage rate set by the employer. For example when an employer pays you an annual salary of 40000 per year this means you have earned 40000 in gross pay. This is usually the amount of money offered in your initial conversations or the number you negotiated for.

Gross pay often called gross wages is the total compensation earned by each employee. A form of PAY made to employees of an organization. Gross pay synonyms Gross pay pronunciation Gross pay translation English dictionary definition of Gross pay.

What Are Gross Wages Definition And Overview

Gross Salary Definition Importance Example Human Resources Hr Dictionary Mba Skool Study Learn Share

The Difference Between Net Pay And Gross Pay A Simple Guide Hourly Inc

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Gross Salary Vs Net Salary Top 6 Differences With Infographics

What Is Gross Income For A Business

Gross Wage Calculation Defined Contribution Plan Auditor

What Is Base Salary Definition And Ways To Determine It Snov Io

What Is A Adjusted Gross Income Agi Tax Lingo Defined Youtube

Gross Salary Definition Importance Example Human Resources Hr Dictionary Mba Skool Study Learn Share

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

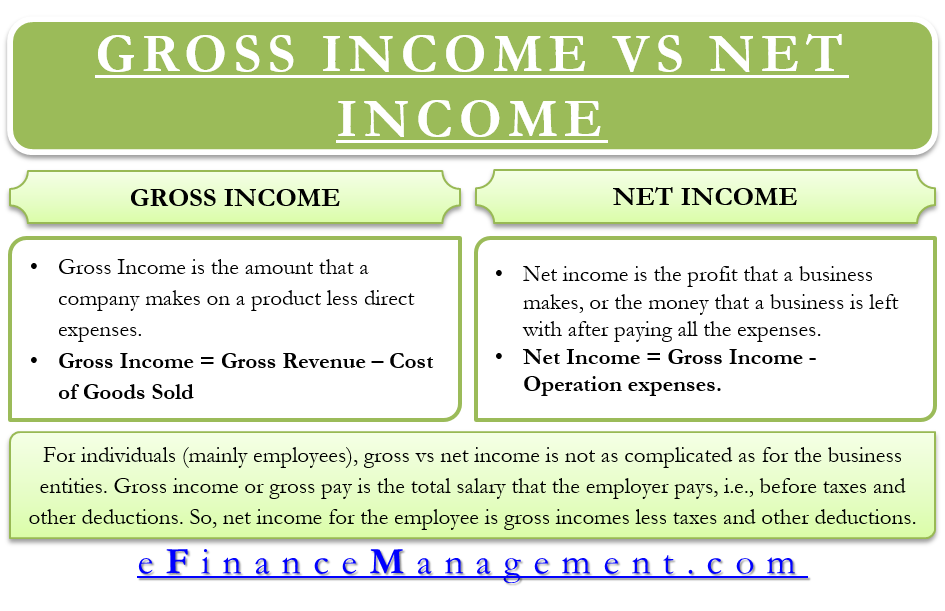

Difference Between Gross Income Vs Net Income Definitions Importance

The Difference Between Gross And Net Pay Economics Help

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

What Is Base Salary Definition And Ways To Determine It Snov Io

What Is Payroll Definition And Examples Market Business News

Gross Vs Net Learn The Difference Between Gross Vs Net

Post a Comment for "Gross Pay Definition"