Net Wages Ytd Meaning

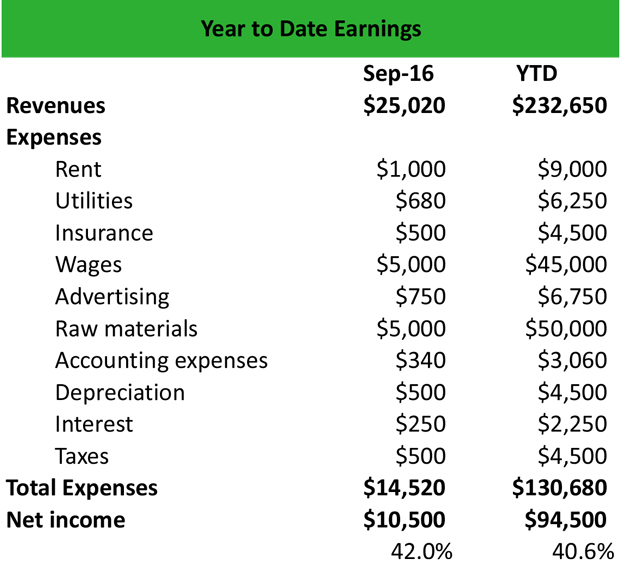

To easily calculate your companys year-to-date payroll gather each employees pay stub and calculate the year-to-date gross. YTD can also include the money paid to your independent contractors.

Understanding The Contents Of A French Pay Slip Fredpayroll

There are several practical uses for understanding your YTD amounts.

Net wages ytd meaning. Gross income is calculated by subtracting the cost of goods sold from revenue. State Taxes ST - State tax code. Year-to-date -- or YTD for short -- income represents the income youve received so far this year.

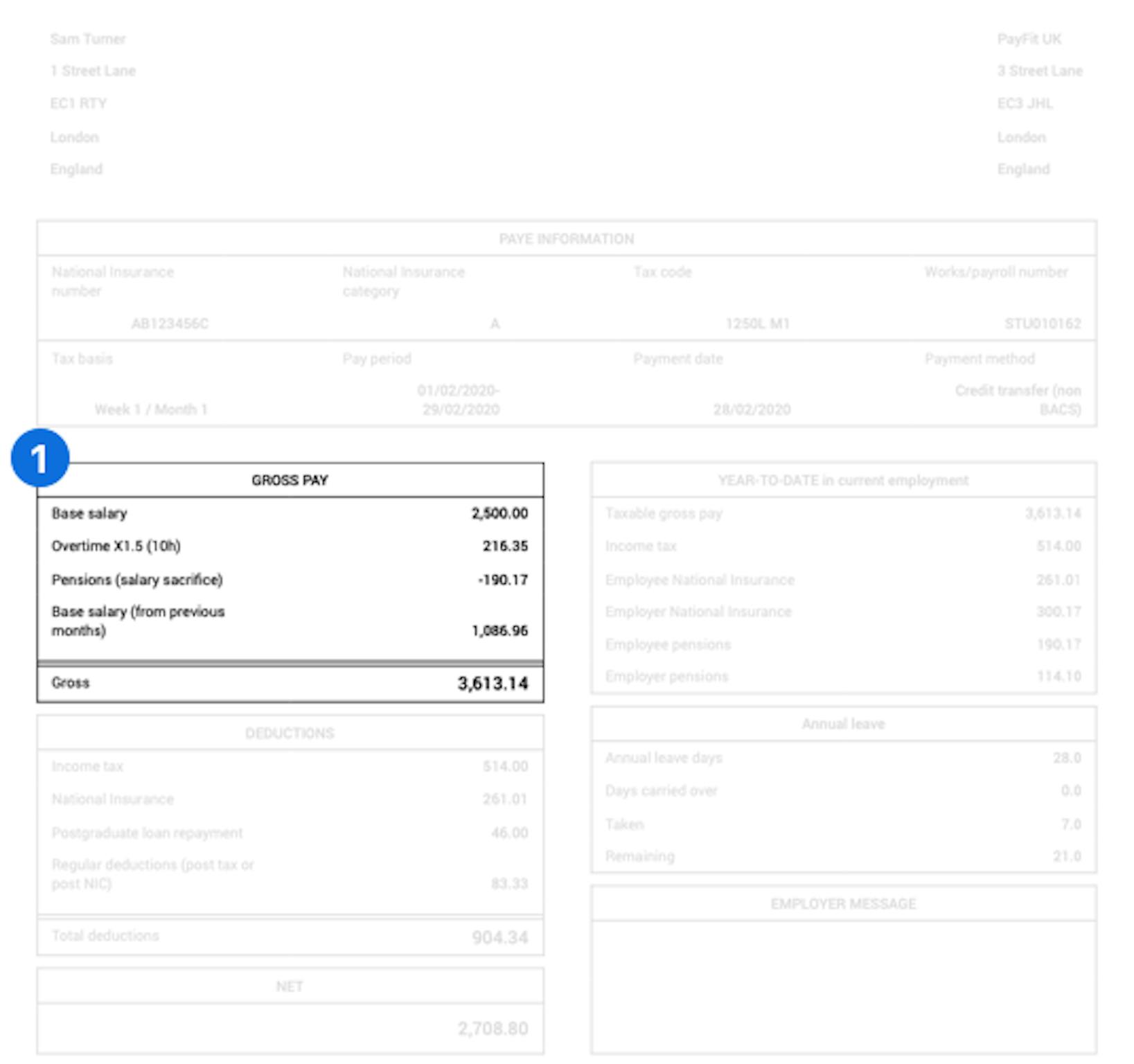

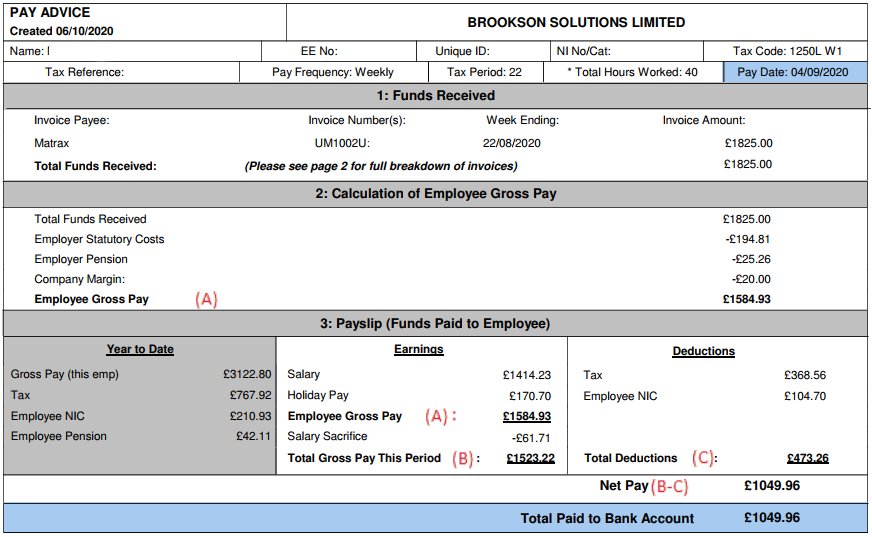

Those with high income may also be subject to Additional Medicare tax which is 09 paid for only by the employee not the. Payslip Terms PayDashboard offers you more than just a PDF payslip portal. Pay stubs are essential to help your employees manage their pay cash flow and understand if they will owe the CRA any money before they file.

YTD income for businesses and YTD income for individuals are calculated differently. Year to date YTD is cumulative earnings accrued from the beginning of the year January 1st to the current date of the payroll. Independent contractors are not your employeesthey are self-employed people hired for a specific job.

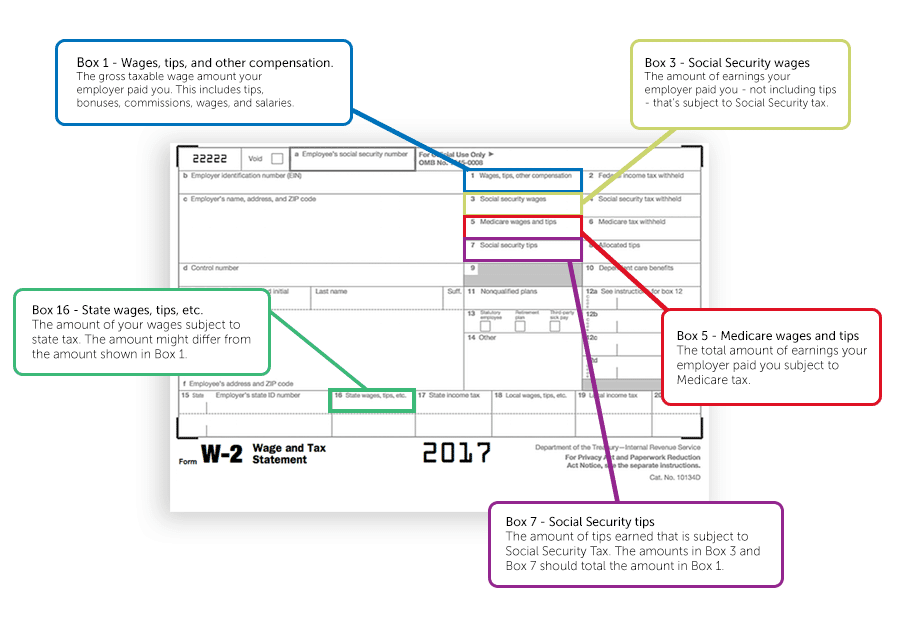

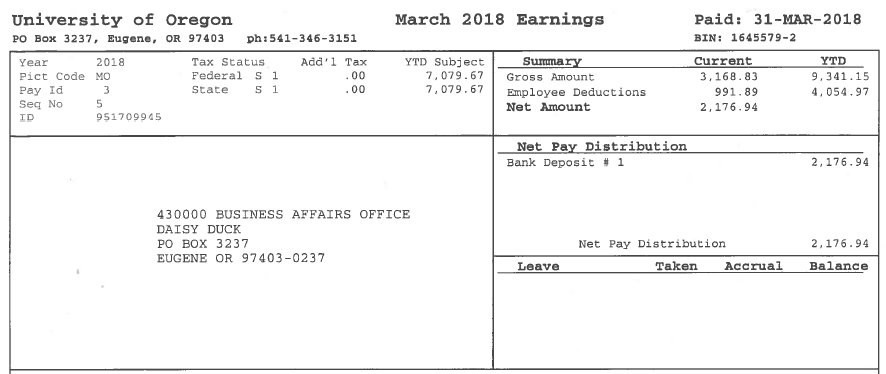

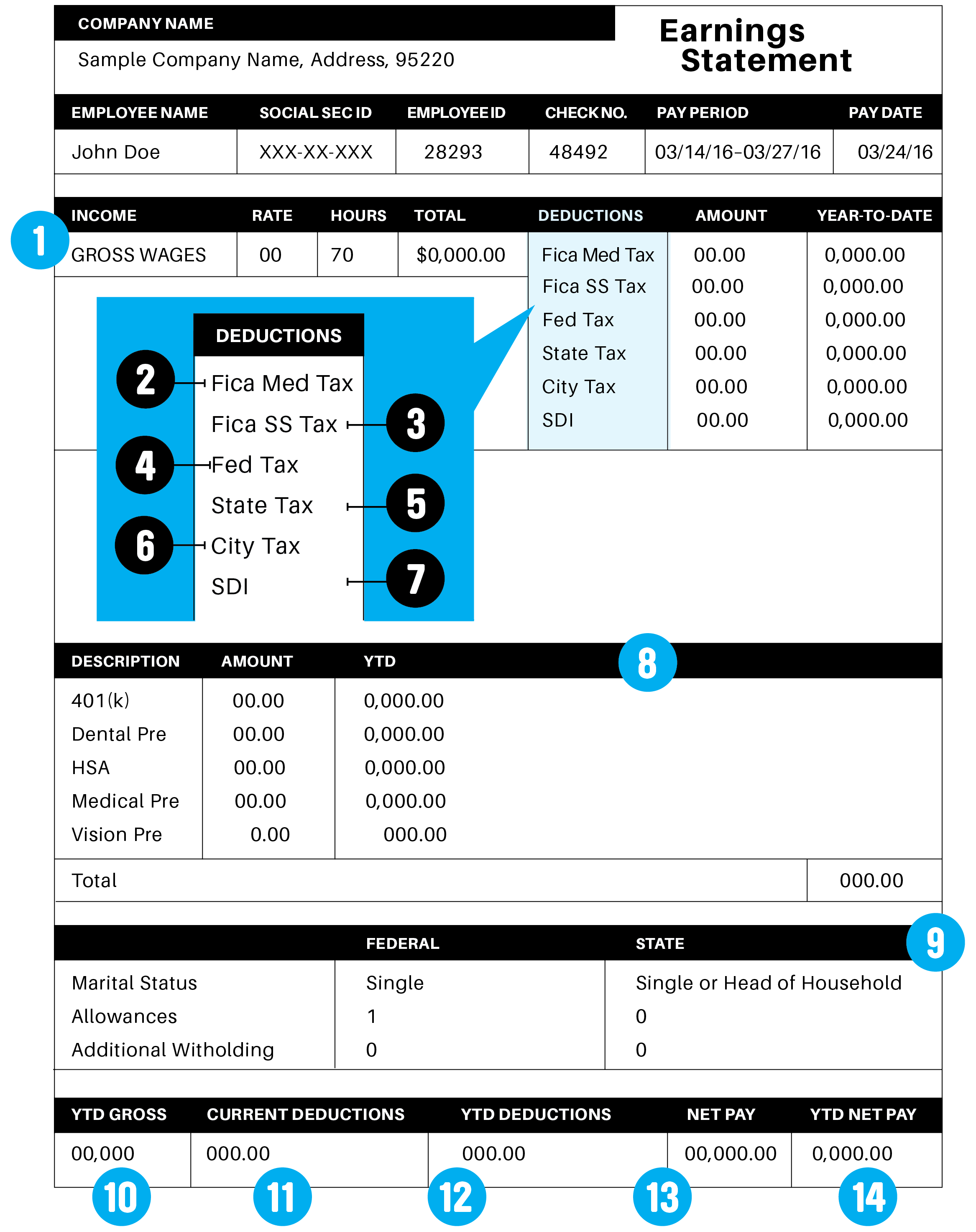

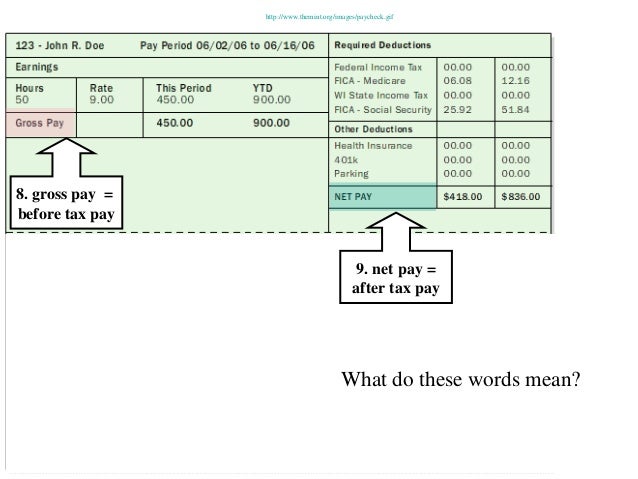

A wage pay stub lists an employees gross salaries taxes and deductions and net wages. A notation for year-to-date deductions or YTD deductions on your pay stub or other accounting papers generally refers to any money deducted from your income or payments since the beginning of the current calendar year although occasionally it can refer to. Gross vs Net Income.

Work Hours Per Week. WAGE PERIOD - Current state wage earned. Our digital payslips also.

TD OR YTD This means To Date or Year To Date. Now lets dive in. The money earned year-to-date that is subject to FITW.

Tax Bands Tax Rates. 5284 74 543 966. FICA is a two-part tax.

YTD Deductions - this is the amount that was deducted from a persons YTD Gross. The latter has a wage base limit of 142800 which means that after employees earn that much the tax is no longer deducted from their earnings for the rest of the year. The amount of money earned this LES period that is subject to Federal Income Tax Withholding FITW.

The Social Security Wage Base for 2019 was 132900. Gross income is the amount an employee earns before taxes and deductions are taken out. YTD Net Pay - this is the amount a person earned for the year after deductions.

This is the total of FICA moneys withheld so far. YTD income for businesses is referred to as net income and is reduced by business expenses. The wages earned so far this year that are subject to FICA.

The paystubs keep track of various YTDs like regular earnings withholdings and other deductions along with gross pay and net pay. YTD is calculated based on your employees gross incomes. Social Security and Medicare Taxable Wage Adjustments to Gross Pay YTD.

In this article well take a closer look. As well as showing earnings and deductions for that specific pay period your payslip should also show you a combined total for that tax year to date. Values less than or equal to 1000 will be considered hourly.

Simply stated your YTD short for Year-to-Date amount shows the sum of your earnings from the beginning of the current calendar year to the present time or the time your pay stub was issued. Both employees and employers pay 145 for Medicare and 62 for Social Security. MED WAGE YTD - Medicare wage earned year to date.

YTD is calculated as a straight sum of similar line items on each paystub from the beginning of the year. MED TAX YTD - Medicare deductions year to date. Here are some of the most common ways and what they all mean.

YTD Gross - this is the amount a person earned for the year before deductions. In the context of weight gross refers to the weight of the product and the packaging. In the context of weight net refers to the weight of the actual product without the packaging.

To determine Social Security and Medicare taxable wages on your W-2 again begin with the Gross Pay YTD from your final pay stub and make the following adjustments if applicable. Gross and Net Calculator.

What Is Year To Date Ytd Earnings Definition Meaning Example

How To Read Your Pay Stub Asap Help Center

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

W 2 Vs Last Pay Stub What S The Difference Aps Payroll

Understanding What S On Your Payslip

How To Read Your Earning Statement Business Affairs

What Everything On Your Pay Stub Means Money

6 Important Things You Need To Know About Your Paycheck

Understanding Your Pay Statement Office Of Human Resources

Understanding The Contents Of A French Pay Slip Fredpayroll

A Guide On How To Read Your Pay Stub Accupay Systems

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Understanding Your Paycheck Credit Com

Your Umbrella Payslip Explained Brookson Faq

How To Read Your Paycheck Khi Solutionskhi Solutions

Payslip In France How Does It Work Blog Parakar

Why Is My Net Pay Higher Than My Gross Pay Quora

Post a Comment for "Net Wages Ytd Meaning"