Gross Salary Meaning Australia

Gross and net calculator. Gross Salary is the amount employee earns in the whole year span of time without any deduction.

Types Of Taxes Anchor Chart Financial Literacy Lessons Financial Literacy Anchor Chart Teaching Economics

The most typical earning is 66695 AUD.

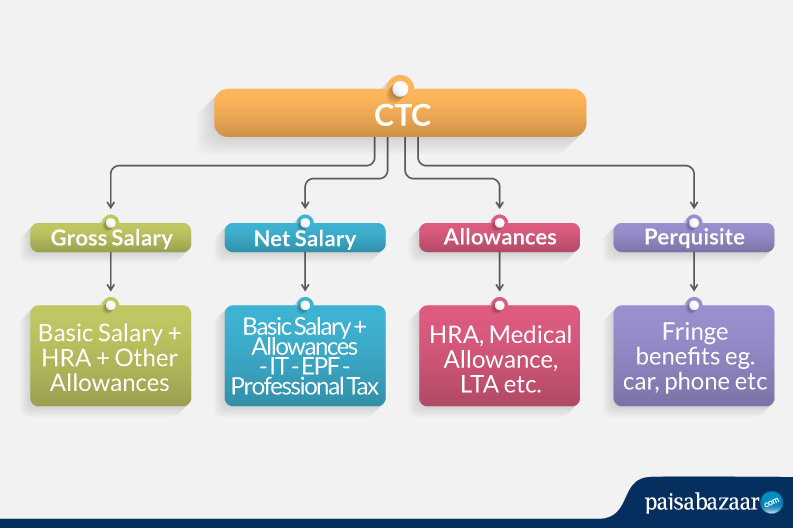

Gross salary meaning australia. For instance you will have to deduct HRA exemption any home loan EMI investments under section 80C and 80D and similar such things for. Net wages means take-home paythe amount on the paycheck after the employees gross earnings have been totaled and all taxes. Gross salary Basic salary HRA Other Allowances.

Taxation Process of Gross Salary. This procedure is called Salary Sacrifice because the employee sacrifices some part of their salary. Your employer will pay an extra 7286 into your Super fund as the compulsory super payment.

The aim of salary packaging is to enable an employee to receive a combination of income and benefits in a tax-effective manner. All data are based on 3277 salary surveys. Women receive a salary of 93532 AUD.

Therefore Net Salary Gross Salary Deductions Rs70000 Rs14000 Rs56000. According to the 2018 Robert Half Salary Guide a network engineer can earn a base salary. Salaries are different between men and women.

The sum of all those individual components on a yearly or monthly basis is the gross salary. The gross salary is mentioned in the companys offer letter in the compensation or salary section which mainly enlist all the components of the pay package. For example you will have to deduct HRA exemption any home loan EMI investments under section 80C and 80D and similar such things for calculation of taxable income.

Gross salary can be defined as the amount of money paid to an employee before taxes and deductions are discounted. Gross salary is basically the salary which is without any deductions like income tax PF medial insurance etc. The key to tax-effective salary sacrifice is for the employee to take some of their remuneration in the form of concessionally taxed benefits instead of taking it all as fully assessable salary.

What is Gross Salary. Here a basic salary is the base income of an employee or the fixed part of ones compensation package. For calculation of Income Tax gross salary minus the eligible deductions are considered.

It can be used for the 201314 to 202021 income years. Gross Salary is the sum total of all the components of your compensationsalary package. The Australian Salaries is on its way to becoming one of the largest salary surveys in Australia.

Gross earnings include the basic salary plus all additional money earned such as sales commissions and bonuses. A pay period can be weekly fortnightly or monthly. With a salary package money is usually deducted from your salary before tax for these items or services.

Gross salary is the maximum amount of the salary inclusive of all taxes. Certain receipts such as lump sum receipts windfall gains and withdrawals from savings are not considered to conform to these criteria and are not included as income. A fantastic salary guide on what you should be earning -- in just a few clicks.

So Net Salary Gross Salary Deductions Rs83000 Rs13000 Rs70000. Taxation Process of Gross Salary. It is up to the individual employer whether they advertise the salary or the salary package in job ads however Andrew Brushfield Director of Robert Half Australia says it is more common for a salary package to be advertised.

You will pay 16929 in tax and medicare but you are also entitled to. Gross payments Include all salary wages bonuses and commissions you paid your payee as an employee company director or office holder. So if you earn the current median male full time wage of 76700 as a base wage.

It is the gross monthly or annual sum earned by the employee. Gross income is regarded as all receipts which are received regularly and are of a recurring nature. Gross salary is the term used to describe all of the money youve made while working at your job figured before any deductions are taken for state and federal taxes Social Security and health.

To calculate Income Tax gross salary minus the eligible deductions are considered. Net Salary is the salaried employees net amount after deduction Income Tax PPF Professional Tax. Men receive an average salary of 118571 AUD.

Average salary in Australia is 111241 AUD per year. It is the gross monthly or annual sum earned by the employee. Gross salary is calculated by adding an employees basic salary and allowances prior to making deductions including taxes.

It is also before tax. Net salary is less than the Gross salary amount after deducting all taxes. Gross salary calculation can be initiated with the help of this mathematical formula.

The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period. Include the total gross.

Your Invoices Gross Or Net Pricing Debitoor Invoicing

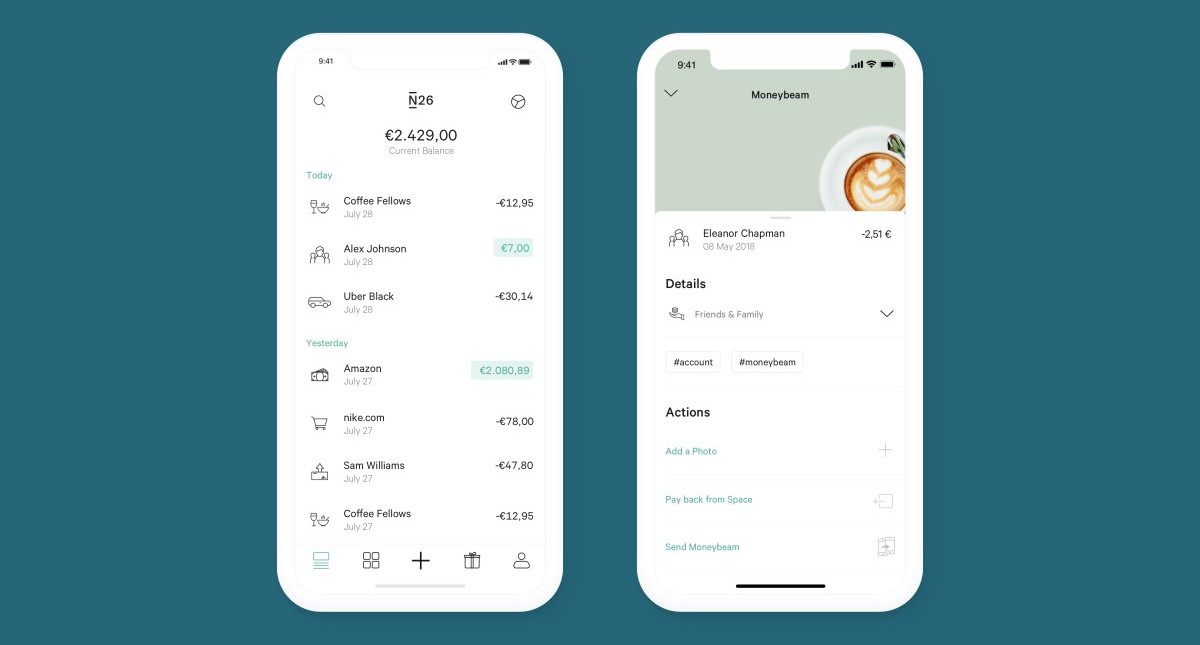

Base Salary Explained A Guide To Understand Your Pay Packet N26

Silhouette Happy Family Fichier Vectoriel Libre De Droits Sur La Banque D Images Fotolia Com Image Silhouette People Family Silhouette Family Illustration

Ytd Calculator And What Is Year To Date Income Calculator

Which Countries Use The Most Electricity Https Www Statista Com Chart 19909 Electricity Consumption Worldwi Electricity Consumption Electricity Infographic

Download Adoption Tax Credit Calculator Excel Template Exceldatapro Tax Credits Excel Template Federal Income Tax

Pin On Small Business Tax Tips

Understanding Gross Vs Net Moneyhub Nz

6 Essential Words To Understanding Your Business Finances Business Finance Finance Small Business Bookkeeping

Drapeau Europe Mutine Newsy Un Drapeau Europeen Incomplet Symbole D Une Chute Cards Gender Studies Country Flags

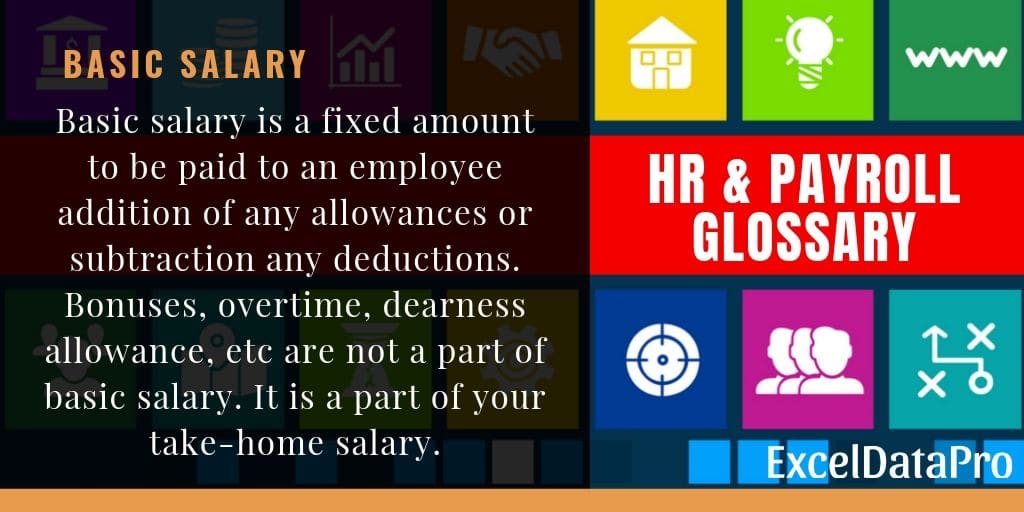

What Is Basic Salary Definition Formula Income Tax Exceldatapro

Income Statement Template Income Statement Template For Excel By Www Vertex42 Co Income Statement Income Statement Template Financial Statement Templates

Salary Calculator Difference Between Gross Salary And Net Salary

What Is Depreciation Meaning And Calculation Striaght Line Method In Ur Meant To Be Method Financial Accounting

Base Salary Explained A Guide To Understand Your Pay Packet N26

Base Salary Explained A Guide To Understand Your Pay Packet N26

Financevocabularywithenglishmedium In Accounting Revenue Is The Income That A Business Has From Its Normal Bu Word Of The Day Accounting And Finance Words

Salary Structure Components How To Calculate Take Home Salary

Post a Comment for "Gross Salary Meaning Australia"