President Salary Exempted From Income Tax

The Salary and other perks are decided through The Presidents Emoluments and Pension Act 1951. It is also used to fix the pension and other benefits of retired President.

The Math Behind President Kovind S Tax Outgo

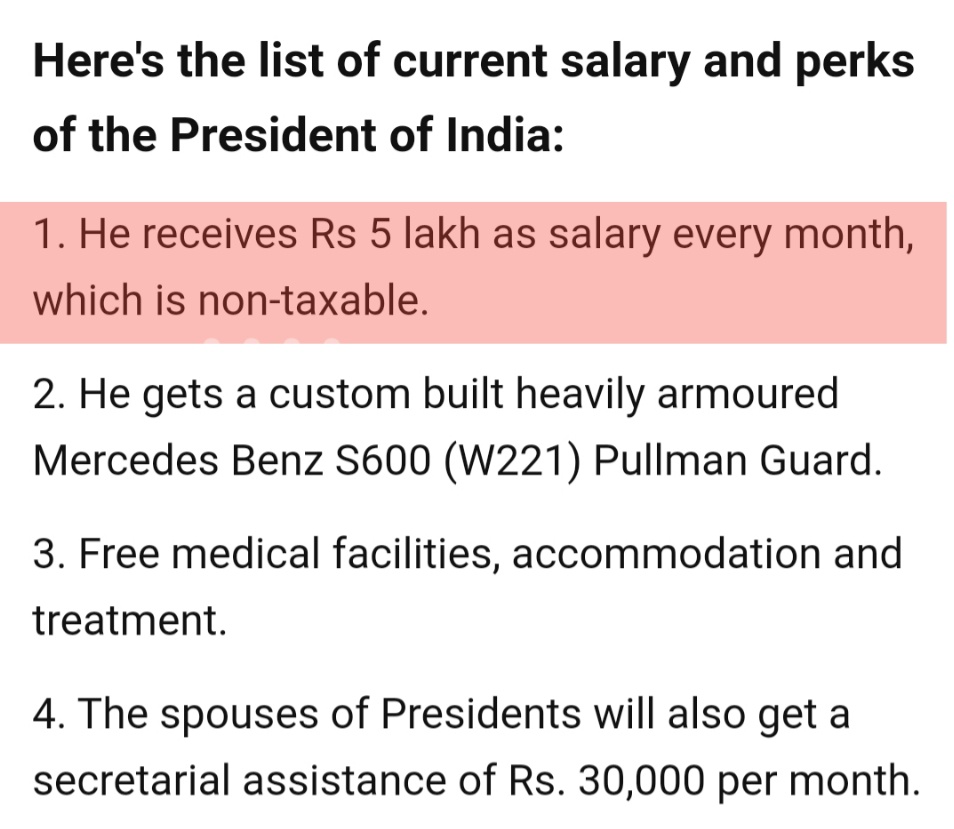

President Ram Nath Kovind on June 27 2021 said his salary is Rs 5 lakh a month and of it Rs 275 lakh go into taxes.

President salary exempted from income tax. 5 lakh rupees per month. The salary of the President of India is thus determined by the 1951 Presidents Emoluments and Pensions Act. So does that mean the President of India pays taxes like any other employee.

The President is the first citizen of the country and also the highest official. If youre a low-income earner on N30000 per month or less youre now exempted from personal income tax based on the new Finance Act Oyedele said. Speaking at a public event he said that while he does earn a healthy salary of Rs 5 lakh a month as President of India he is not able to save much as he pays Rs 275 lakh as tax every month.

They have to pay Income-Tax as per rules applicable to them according to the Income-Tax Act in force. Through an amendment to the Finance Bill in 2018 the Presidents salary was last revised to Rs. The Salary and other perks are decided through The Presidents Emoluments and Pension Act 1951.

Having said that the President would be paying tax but not likely to the scale of what Ram Nath Kovind has said. Akhilesh Sharma the Executive Editor of NDTV tweeted. - a Agricultural income b Bank profits c Salary income d Profit of public Ltd.

Neither the Constitution nor the Presidents Emoluments and Pensions Act 1951 exempt the Heads of State from taxation Mridhula Raghavan. First Presidents Salary Is Not Exempt From Income Tax The Presidents Emoluments And Pension Act 1951 lays down provisions for the salary. The Persons who holds the post of the Prime Minister of India and the President of India also have to pay Income Tax as they are not exempt from paying the Income -Tax as per the Income Tax Act.

The salary and emoluments are decided by the Presidents Emoluments and Pensions Act 1951 which was amended recently where the Presidents salary was hiked to five lakhs and is tax. There is no evidence that says the President of India is exempted from paying Income tax. So tell your employer to.

This act has been amended from time to time to review the salary. The salary and emoluments is decided by the Presidents Emoluments and Pensions Act 1 9 5 1 which was amended recently where the Presidents salary was hiked to five lakhs and is tax free. Further the Income Tax Act and the The Presidents Emoluments and Pension Act 1951 do not exempt the Presidents salary from income tax.

Neither under the Constitution nor under the The Presidents Emoluments And Pension Act 1951 it has been mentioned that the Salary or emoluments paid to the President of India are Tax Free. As per the report the President is not exempted from paying the tax as there was no taxation exemption for the Presidents salary under the Income Tax Act and under the President Emoluments and Pension Act. The President of India pays Income Tax.

However there is no light on clarity on the nature of the. Neither the Income Tax Act nor the President Emoluments and Pension Act specify the exemption from the salary of the President of India from taxation. It is deducted at the source.

The answer is that the President of India is not exempted from Income tax. It is also used to fix the pension and other benefits of retired President. The answer is NO because of a simple reason that the President of India is not paid Salary as he is not an employee.

He pointed out that as a result of this he makes fewer savings than several other officials in. He said I am mentioning this because everyone knows that there is nothing wrong. Find Answer to MCQ Which of the following is exempted from tax at present.

It is needless to say that the income of the president is Tax free. This act has been amended from time to time to review the salary.

No The President Of India Is Not Exempted From Income Tax

President Of India Salary Controversy How Much Does President Of India Earn Is It Taxable Youtube

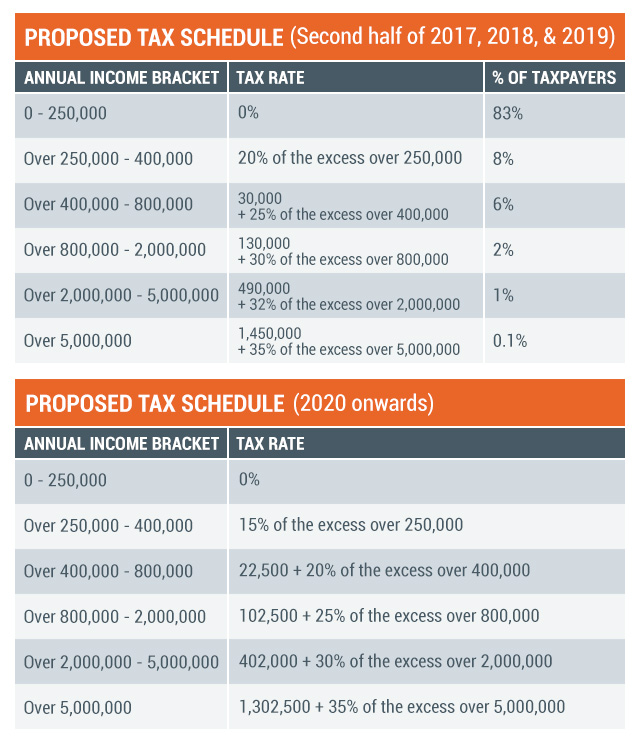

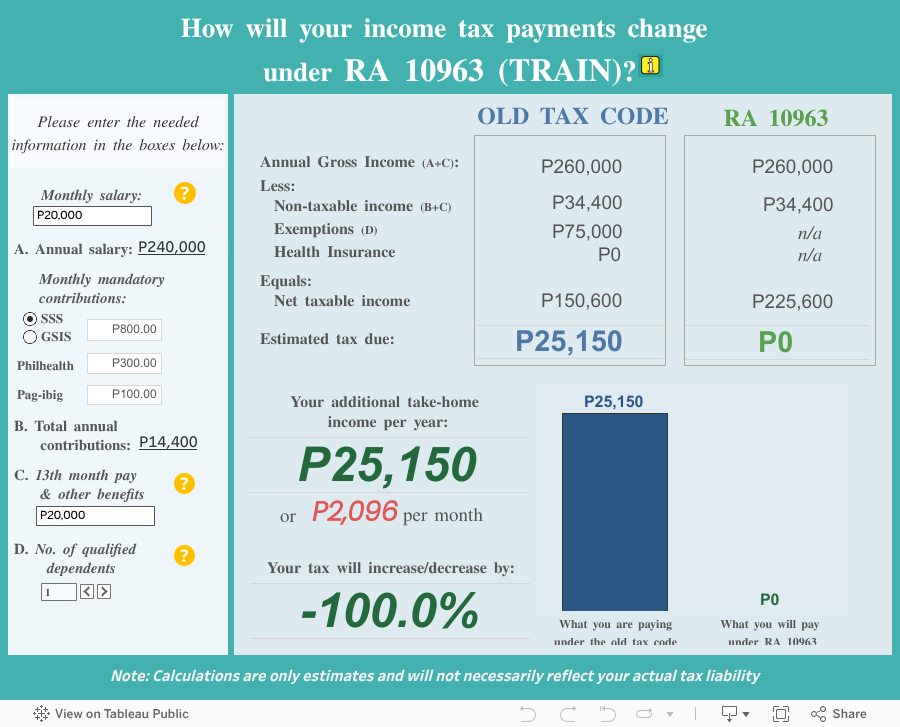

Duterte S Tax Reform More Take Home Pay Higher Fuel And Auto Taxes

Yes The President Of India Pay Income Tax But Not More Than 50 Of His Salary Facto News

Do U S Presidents Pay Taxes The Official Blog Of Taxslayer

Does The President Of India Ram Nath Kovind Pay Income Tax

Whether Salary Of The President Of India Is Taxable Law Trend

Who Pays U S Income Tax And How Much Pew Research Center

President Kovind Revealed His Monthly Salary Gulte Ramnath Kovind

Yes The President Of India Pay Income Tax But Not More Than 50 Of His Salary Facto News

Yes The President Of India Pay Income Tax But Not More Than 50 Of His Salary Facto News

Do You Know The Salary Of The President Of India Education Today News

Yes The President Of India Pay Income Tax But Not More Than 50 Of His Salary Facto News

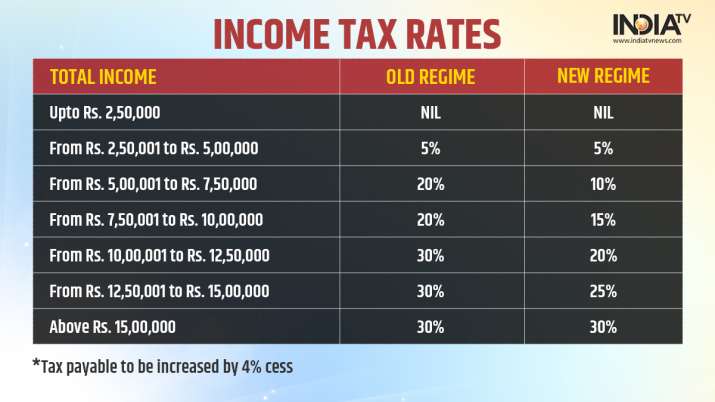

Income Tax Rates For Fy 2021 22 How To Choose Between Old Regime And New Regime Income News India Tv

Siddharth Setia On Twitter But President S Salary Is Tax Free Why Is He Lying

Duterte S Tax Reform More Take Home Pay Higher Fuel And Auto Taxes

No The President Of India Is Not Exempted From Income Tax

Post a Comment for "President Salary Exempted From Income Tax"