Hourly Vs Salary Determination

Eligibility for more better benefits 4. As a business owner you can pay your nonexempt employees by the hour or through a fixed salary.

![]()

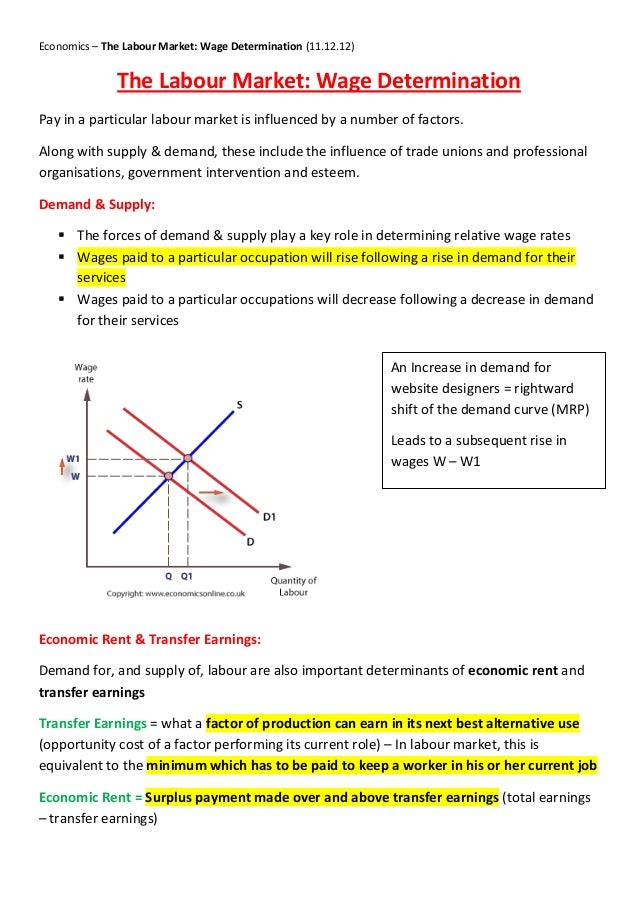

How To Read A Wage Determinations Ebacon

The main difference between the two is that a salaried income is set in advance while hourly pay fluctuates depending on the amount of time you work.

Hourly vs salary determination. The right tool will help you determine whether its best to work as an hourly or salary employee. Overtime pay of time and a half for each hour worked after 40. Whether an employee is paid on a salary basis is not affected by whether pay is expressed in hourly terms as this is a fairly common requirement of many payroll computer programs but whether the employee in fact has a guaranteed minimum amount of pay she can count on.

Paid time off and sick days 3. This annual amount is divided between pay periods the company determines for that year according to the 2080-hour ruling. No matter how many hours they work salaried staff are paid a set amount.

If your hourly rate is 1750 youll receive 44625 for your. Time and a half 3. When building your workforce and evaluating your organizations structure of hourly employees vs.

Ability to dedicate time to other interests 4. When building your workforce and evaluating your. The FLSA salary basis test applies only to reductions in monetary amounts.

Hourly Pay Pros 1. In the US. Lets assume that hourly rate equals 14 and the employee has worked 120 hours per month with no overtime.

The employee must be compensated either on a salary or fee basis as defined in the regulations at a rate not less than 684 per week or if compensated on an hourly basis at. Since clocking in is obligatory for hourly employees its much easier to calculate it automatically than to add all numbers in. The wage rate on the wage determination is the prevailing rate for the occupation in the locality.

Earn a salary equivalent to at least twice the state minimum wage for full-time work based on a 40-hour workweek. As an hourly employee you should get paid for all of the hours that you work. Salary Pay Pros 1.

Some autonomy over your schedule. Your hourly rate is the amount of money that you receive for each hour you spend working. Top 7 Free Payroll Calculators.

The prevailing rate then becomes the minimum rate that the contractor must pay its employees working on the contract. What does it mean to have a salary. Workers paid hourly are compensated by multiplying the agreed hourly rate by the total number of hours worked in a given period eg month week or day.

As a business owner you can pay your nonexempt employees by the hour or through a fixed salary. Though an employee paid by salary receives payment weekly the monetary amount determining the weekly pay is annual. Some hourly vs salary calculators take into account such details as deductions taxes and other values.

Labor laws for salaried versus hourly employees are codified by the US. Salaried employees its important to consider the nature of the role the job duties salary. 18 As of January 1 2021 the minimum annual salary to qualify for an exempt employee would be 58240 Double the state minimum wage 1400hour for employers with 26 or more employees is 2800hour x 40 hoursweek x 52 weeks 58240.

14hour 120 hours 1680. So the salary looks like this. Is the rate on the wage determination the minimum hourly rate.

The rules contained in the act are enforced by the agencys. More career advancement opportunities. Their gross pay can vary from paycheck to paycheck because its determined by how many.

For example if you work for 25 hours and 30 minutes youll get paid for 255 hours. If an employer wants more of your time theyll have to pay you more. What is a Salaried Employee.

How are wage rates determined for classes that are not surveyed. Department of Labor in the Fair Labor Standards Act of 1938. Most people get paid either through a salary or hourly pay.

Hourly employees are paid for the exact amount of time they work each pay period although they can also earn paid sick time and paid time off. Federal and state employment laws require a classification of salary or hourly. Pay varies based on the hours you work.

Chapter 17 Wage Determination Ppt Download

Wages Factors That Affect Wage Levels And Wage Determination Under Pure Competition

Chapter 6 Determination Of Wages Importance Of Wages Wage Structure At Point In Time And Changes Over Time Serve To Efficiently Allocate Labor And To Ppt Download

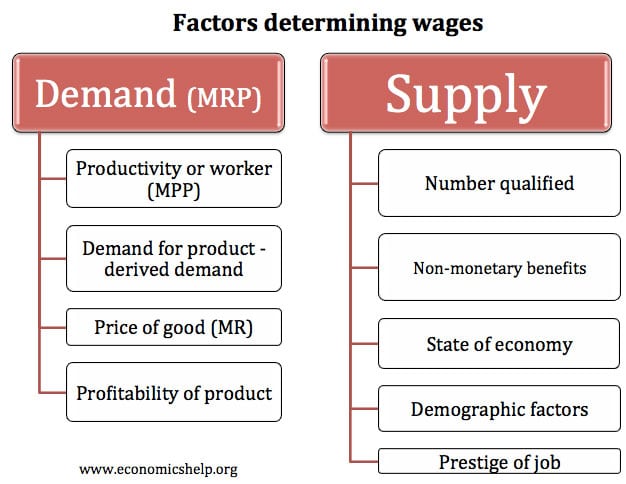

What Determines Pay Wages Economics Help

Free Hourly Market Trend Currency Commodity And Equity Today S Crudeoil Trend 15 04 2019 11 05 Am Marketing Trends Commodity Market Marketing

Minimum Wage System Minimum Wage Council Republic Of Korea

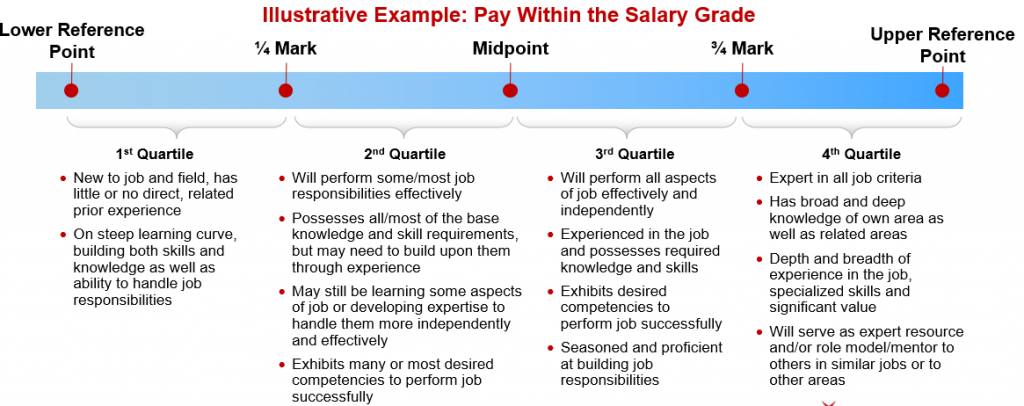

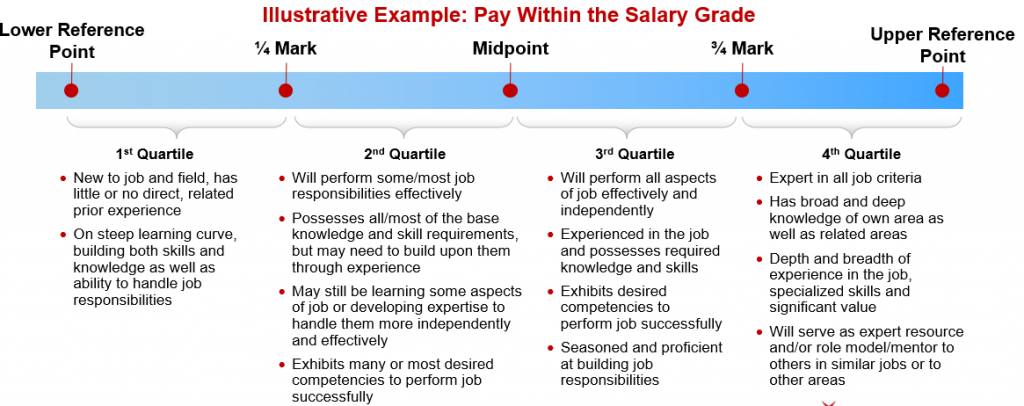

Staff Salary Structure Overview Determining Individual Compensation Uf Human Resources

Pdf The Theory And Practice Of Pay Setting

What Determines Pay Wages Economics Help

Holiday Pay Is An Appreciated Employee Benefit That Employers Offer To Recruit And Retain The Best Employees In Competition Holiday Pay Practice Good Employee

Wage Determination In Perfectly Competitive Labour Markets Economics Help Economics Wage Labour Market

Ch 11 Pay And Productivity Wage Determination Within

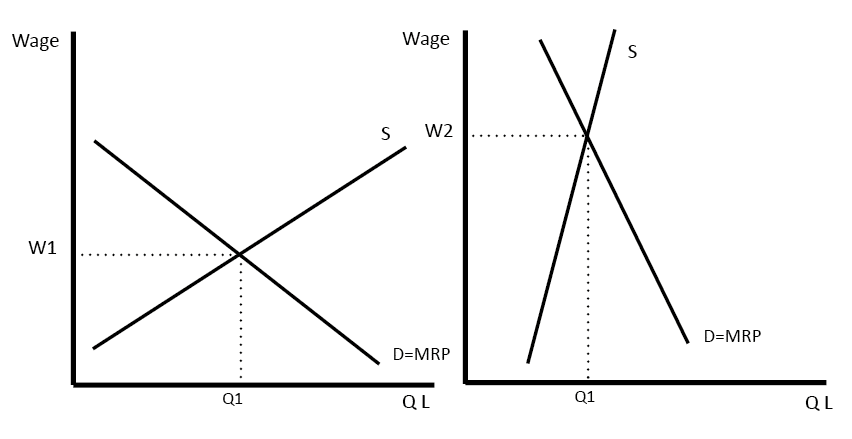

The Labour Market Wage Determination

Lunasangel Business Quotes Money Quotes Mindset Quotes

Ppt Chapter 6 Determination Of Wages Powerpoint Presentation Free Download Id 4502501

California Certified Payroll Report Requirements Payroll Payroll Template Templates

Pin By Corporate Bytes On Money Corporate Quotes Business Quotes Billionaire Sayings

Sample Resignation Letter Fax Cover Sheet Sample Thank You Letter Job Proposal Letter Examples Of Propo Proposal Letter Proposal Templates Agreement Letter

Entrepreneur Entrepreneurial Entrepreneurmind Entrepreneurlifestyle Gary Vee Jack Ma Bill Gates Success Bitcoin Hack Bitcoin Generator Bitcoin Mining Software

Post a Comment for "Hourly Vs Salary Determination"